However, volatility is not the best measure of an investor’s comfort level.

Higher volatility means higher risk, because there is more uncertainty around where the price will be at any particular point in time.

Bonds should be considered defensive assets, as they lower a portfolio’s overall risk and provide a more stable return stream.įinance professionals often describe risk in terms of volatility, which is a measure of the dispersion (or range) of returns for an asset. Growth assets, such as stocks, have greater potential for higher returns, but also have more risk, or volatility. Portfolio risk should be evaluated against prospective benefits. A truly goals-based approach to investing first tries to limit the level of portfolio risk within a comfortable range and then focuses on maximizing risk-adjusted returns.

#Portfolio drawdown full#

It’s far better to stay invested through the full market cycle, usually five to 10 years from economic boom to recession and back to boom again, than to dip in and out. That’s because they are more likely to sell after bad news is already priced into the market or buy after the market has rebounded. As the chart below shows, the average mutual fund investor underperforms most major asset classes.

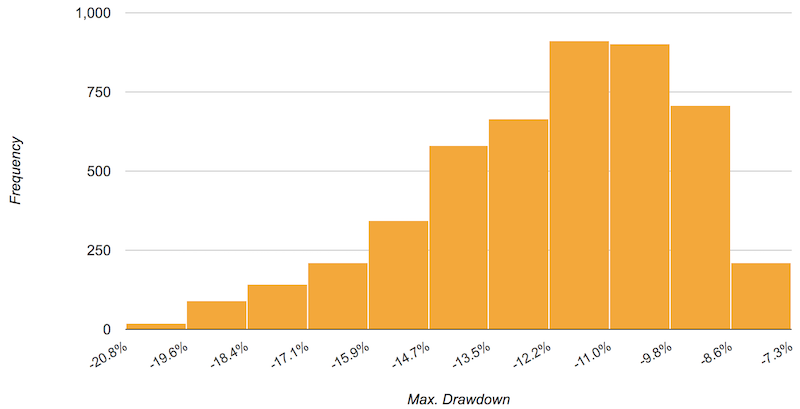

Look at what happens when investors try to time the markets. If these movements are outside an investor’s comfort range, there’s another risk at play: that he or she will abandon an investment plan, with potentially unfortunate consequences. A portfolio that holds risky assets has a greater likelihood of more extreme movements.

0 kommentar(er)

0 kommentar(er)